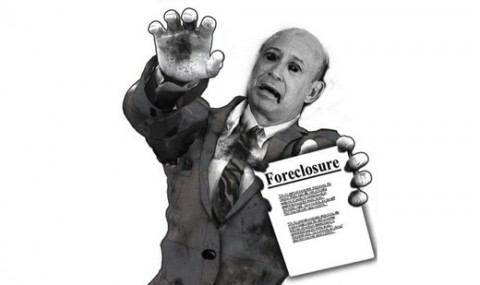

Zombie foreclosures. This bizarre term refers to a bizarre, little-known but very real horror of the U.S. housing bust that is crippling homeowners coast to coast, six years in. Thousands are finding themselves legally liable for houses they didn’t know they still owned after banks decided it wasn’t worth their while to complete foreclosures. With impunity, banks walk away from foreclosures much the way some homeowners walked away from their mortgages when the housing market first crashed. “The banks are just deciding not to foreclose, even though the homeowners never caught up with their payments,” says Daren Blomquist, vice president at RealtyTrac. Since 2006, 10 million homes have fallen into foreclosure, a number that in earlier, more stable times would have taken nearly two decades to reach. Of those foreclosures, more than 2 million have never come out. In cases where homeowners moved out after receiving notice of a foreclosure sale, thinking they were leaving the house in bank hands, we see the zombie situation. Dozens of housing court judges, code enforcement officials, lawyers and other professionals involved in foreclosures say these titles number in the many thousands. No national databases track zombie titles. “There are thousands of foreclosures in limbo, just hanging out there, just sitting, with nothing being done,” says Cleveland Housing Court Judge Raymond Pianka. The surge is due largely to homes vacated by people who fled before an imminent foreclosure sale, only to learn later that they remain legally responsible for their house. When people move out after receiving a notice of a planned foreclosure sale and the bank then cancels, municipalities are left to deal with the mess. Some spend public funds on securing, cleaning and stabilizing houses that generate no tax revenue. Others let the houses rot, as we’ve seen many times. In at least three states in recent months, houses abandoned by owners and banks alike have exploded because the gas was never shut off. Unsuspecting homeowners nationwide have had their wages garnished, their credit destroyed and their tax refunds seized – all due to zombie titles. They’ve opened their mail to find bills for back taxes, graffiti-scrubbing services, demolition crews, trash removal, gutter repair, exterior cleaning and lawn clipping. At their front doors they’ve encountered bailiffs brandishing summonses. In some cities, people with zombie titles can be sentenced to probation – with the threat of jail if they don’t bring their houses into compliance. If you think this could be happening to you, or for more information on this dubious but very real situation, continue reading this foreclosure explanation .

Read the original:

Zombie Foreclosures: "Undead" Titles Pillaging US Homeowners